Trump Administration Eyes Intel Investment: A Strategic Play for U.S. Semiconductor Dominance

The incoming Trump administration is reportedly exploring the possibility of taking a government stake in Intel Corporation, marking a potential watershed moment in U.S. industrial policy and the global semiconductor race. This unprecedented consideration reflects growing national security concerns and America's determination to maintain its technological edge against international competitors.

National Security Meets Silicon Valley

Sources familiar with the discussions indicate that the Trump team is evaluating various mechanisms to provide Intel with substantial government backing, potentially including direct equity investment or convertible financing arrangements. The move comes as Intel faces mounting pressure from Asian competitors, particularly Taiwan Semiconductor Manufacturing Company (TSMC) and South Korea's Samsung, who have captured significant market share in advanced chip manufacturing.

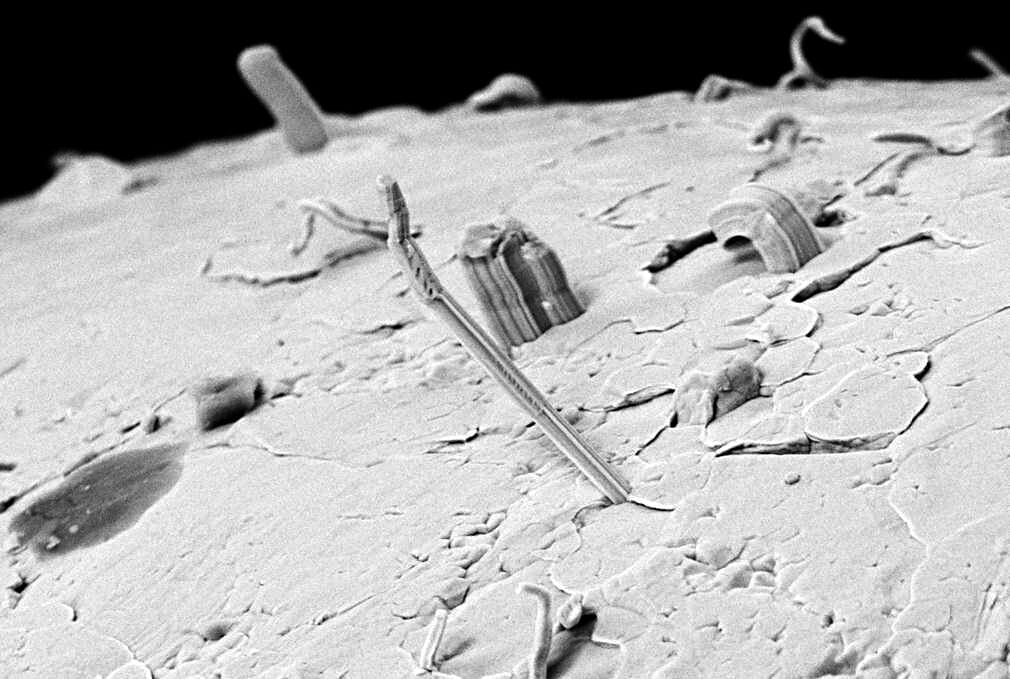

Intel's market capitalization has declined from over $290 billion in 2020 to approximately $100 billion today, while the company struggles to compete in the critical 3-nanometer and 2-nanometer chip manufacturing processes that represent the cutting edge of semiconductor technology. Meanwhile, TSMC commands roughly 60% of the global contract chip manufacturing market.

The CHIPS Act Foundation

This potential government intervention builds upon the bipartisan CHIPS and Science Act of 2022, which allocated $52 billion in subsidies and tax credits to boost domestic semiconductor manufacturing. Intel has already secured $8.5 billion in grants and up to $11 billion in loans under this program, but the company's financial challenges persist.

The semiconductor giant recently announced a $10 billion cost-reduction program, including significant workforce reductions and the suspension of dividend payments. These measures underscore the severity of Intel's competitive position and the urgency behind potential government intervention.

Strategic Implications for American Industry

A government stake in Intel would represent the most direct federal intervention in a major technology company since the 2008 financial crisis bailouts. Proponents argue that semiconductors are too strategically important to allow market forces alone to determine outcomes, particularly given China's aggressive investments in its domestic chip industry.

The Chinese government has committed over $150 billion to semiconductor development through various state-backed funds and initiatives. This massive state intervention has enabled Chinese companies like SMIC to rapidly advance their manufacturing capabilities, though they still lag behind leading-edge producers by several technology generations.

Geopolitical Chess Match

The timing of these discussions coincides with escalating U.S.-China tensions over technology transfer and export controls. The Biden administration has implemented sweeping restrictions on the sale of advanced semiconductors and manufacturing equipment to China, measures that a new Trump administration appears likely to maintain or even strengthen.

Intel's foundry business, which manufactures chips for other companies, is viewed as critical to reducing American dependence on Asian suppliers. Currently, over 90% of the world's most advanced semiconductors are produced in Taiwan and South Korea, creating significant supply chain vulnerabilities for U.S. technology companies and defense contractors.

Market Reaction and Industry Response

Semiconductor industry analysts have expressed mixed reactions to the potential government investment. While some view it as necessary to ensure Intel's survival and America's technological sovereignty, others worry about the precedent of direct government ownership in competitive technology markets.

Intel's stock price has shown volatility amid these reports, reflecting investor uncertainty about the implications of government involvement. The company's ability to execute on its ambitious foundry expansion plans, including new facilities in Arizona, Ohio, and other states, may depend on securing this additional government backing.

Looking Ahead: The Path Forward

As the Trump administration prepares to take office, the Intel investment consideration represents a broader shift toward more interventionist industrial policy. This approach mirrors strategies employed by other nations, particularly in Asia, where government and industry collaboration is more commonplace.

The success or failure of any government stake in Intel will likely influence future technology policy decisions and could set important precedents for how America responds to strategic competition in critical industries. With global semiconductor demand projected to reach $1 trillion by 2030, the stakes could hardly be higher.

The coming months will reveal whether this bold experiment in government-industry partnership can help restore American leadership in one of the 21st century's most vital technologies.