The $80 Video Game Price Ceiling: Why the Industry's Bold Gamble Hit a Wall

The video game industry's ambitious push toward $80 AAA titles has encountered unexpected turbulence, with several high-profile releases failing to justify their premium price points. After years of gradual price increases that saw games climb from $60 to $70, and select titles testing the $80 threshold, consumer resistance and market realities are forcing publishers to pump the brakes on their pricing strategies.

The Price Escalation That Wasn't

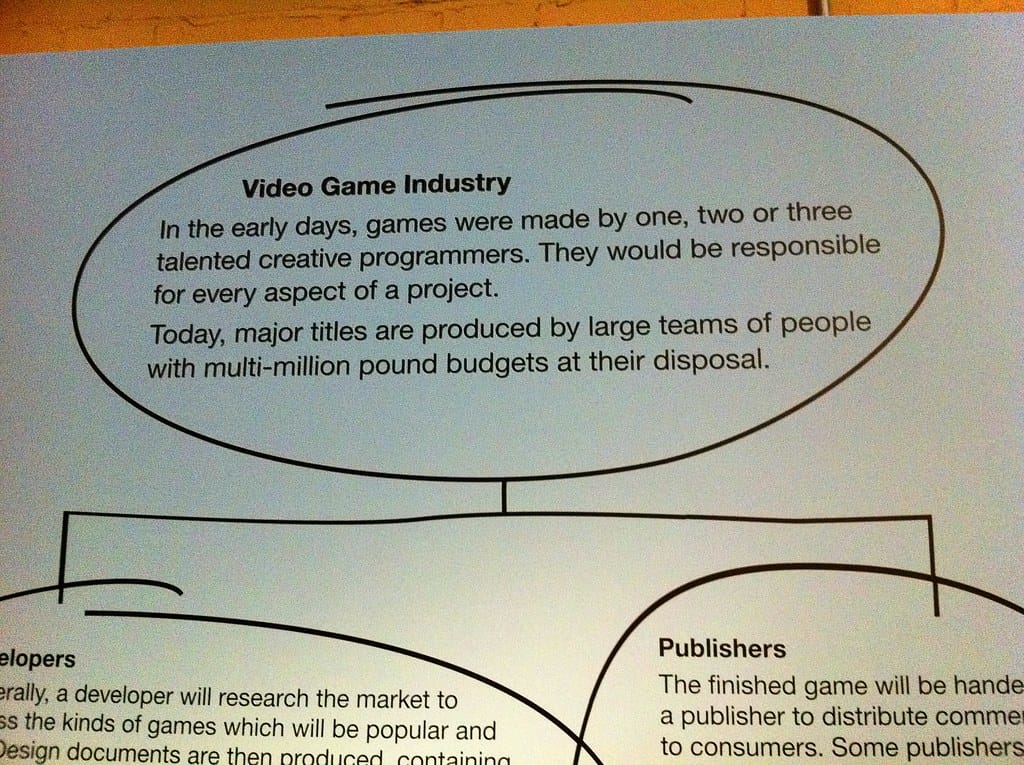

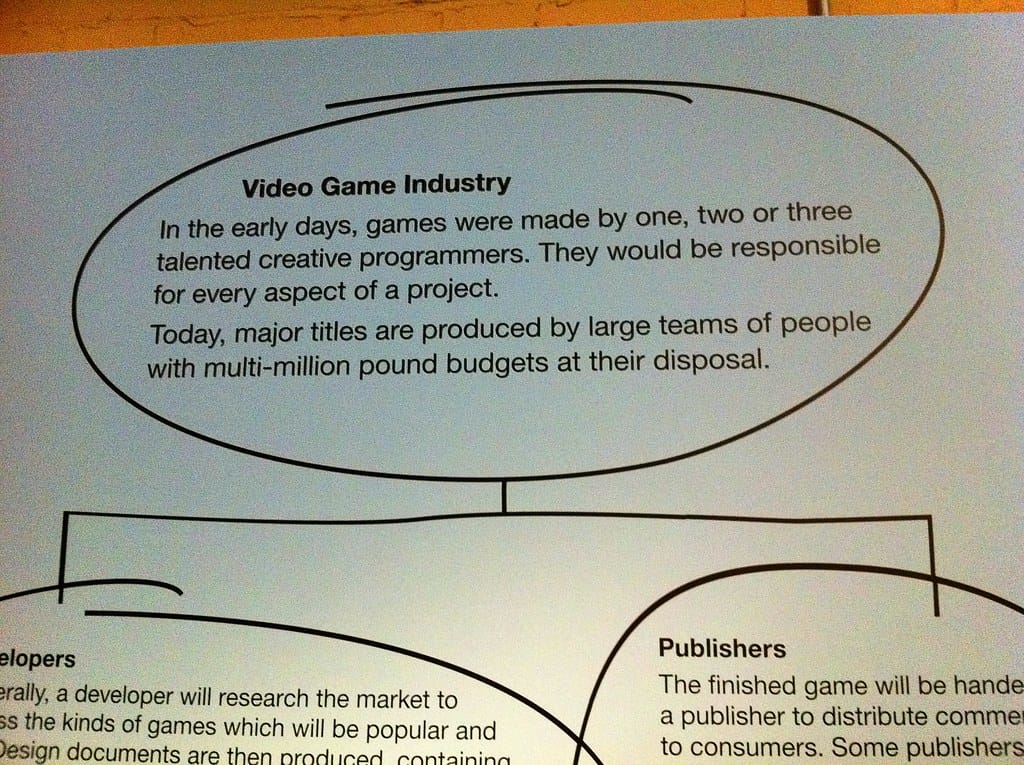

When major publishers like Activision Blizzard and Electronic Arts began floating $70 as the new standard for next-generation console games in 2020, industry analysts predicted a swift progression to $80 titles. The logic seemed sound: rising development costs, inflation, and enhanced gaming experiences would naturally command higher prices.

However, 2024 has told a different story. Despite several publishers testing premium pricing with special editions and day-one releases, the mass market adoption of $80 base games has largely stalled. Recent data from the Entertainment Software Association shows that while $70 games have gained acceptance among core gamers, the jump to $80 has met significant consumer pushback.

Consumer Resistance Meets Market Reality

The stalling of $80 game pricing isn't happening in a vacuum. Economic pressures on consumers, combined with an increasingly competitive gaming landscape, have created a perfect storm of resistance.

"Gamers are becoming more selective about their purchases," explains industry analyst Sarah Chen from GameMarket Research. "With subscription services like Game Pass offering hundreds of titles for $15 monthly, justifying an $80 purchase requires exceptional value proposition."

Recent high-profile launches illustrate this dynamic. Several AAA titles that launched at premium price points saw rapid price drops within weeks of release, suggesting that publishers overestimated consumer willingness to pay top dollar without proven value.

The Subscription Service Factor

The rise of gaming subscription services has fundamentally altered the pricing equation. Microsoft's Game Pass, Sony's PlayStation Plus, and similar services have conditioned consumers to expect access to vast game libraries for monthly fees equivalent to single game purchases.

This shift has created a two-tier market: premium standalone experiences competing against subscription-based gaming ecosystems. Publishers are discovering that charging $80 for games that might appear on subscription services months later is a difficult sell to increasingly savvy consumers.

Quality Concerns and Launch Issues

The industry's pricing ambitions have been further complicated by a series of problematic launches. High-profile releases plagued by bugs, incomplete features, and technical issues have made consumers more cautious about premium purchases.

The gaming community's memory of titles like Cyberpunk 2077's troubled launch continues to influence purchasing behavior. When spending $80, consumers expect flawless experiences from day one – a standard that many publishers have struggled to meet consistently.

Market Segmentation Strategies

Rather than abandoning premium pricing entirely, publishers are adopting more nuanced approaches. Tiered pricing strategies now offer multiple entry points: standard editions at traditional price points, premium editions with additional content, and ultra-premium collector's editions for dedicated fans.

This segmentation allows publishers to capture revenue from willing high-spenders while maintaining accessibility for price-sensitive consumers. Early data suggests this approach is more sustainable than blanket premium pricing across entire catalogs.

The Path Forward

Industry experts predict that the future of game pricing will be more strategic and value-driven. Publishers are likely to reserve premium pricing for their most anticipated titles while exploring alternative revenue models for mid-tier releases.

The integration of post-launch content, seasonal updates, and community features is becoming crucial for justifying higher price points. Games positioned as long-term service platforms rather than one-time purchases are finding more success at premium price levels.

What This Means for Gamers and Publishers

The stalling of $80 game pricing represents a market correction rather than a permanent ceiling. Consumer education about development costs and value propositions will likely influence future pricing strategies, while publishers must balance revenue goals with market acceptance.

For gamers, this pause provides breathing room and reinforces the power of collective consumer choice. For publishers, it's a reminder that pricing strategies must align with perceived value and market conditions rather than development costs alone.

The industry's pricing evolution continues, but the path to premium pricing will require more than wishful thinking – it demands genuine innovation and uncompromising quality that consumers believe justifies the investment.