Intel's $7.86 Billion CHIPS Act Award: Why the "New" Funding Isn't Actually New

The semiconductor giant's massive government funding announcement masks a more complex reality about America's chip manufacturing strategy.

Intel's recent announcement of securing $7.86 billion in federal funding under the CHIPS and Science Act made headlines across financial and tech media. But here's what many reports missed: this isn't actually "new" money. Instead, it represents the formal finalization of grants that were preliminarily awarded months ago. So what does this mean for Intel's ambitious U.S. manufacturing plans, and why should investors and policymakers pay attention?

The Real Story Behind the Headlines

In March 2024, Intel was preliminarily awarded up to $8.5 billion in CHIPS Act grants, with the final amount now settled at $7.86 billion. This funding comes alongside $3 billion in additional federal contracts for secure chip production and up to $11 billion in loans, creating a comprehensive $25+ billion federal investment package.

The timing of the finalization isn't coincidental. With a new administration taking office, there's been a rush to cement these agreements before potential policy shifts. The Biden administration has been working to lock in CHIPS Act commitments, having distributed preliminary awards to major players including Taiwan Semiconductor Manufacturing Company (TSMC), Samsung, and GlobalFoundries.

What Intel Plans to Do With the Money

Massive Factory Expansion

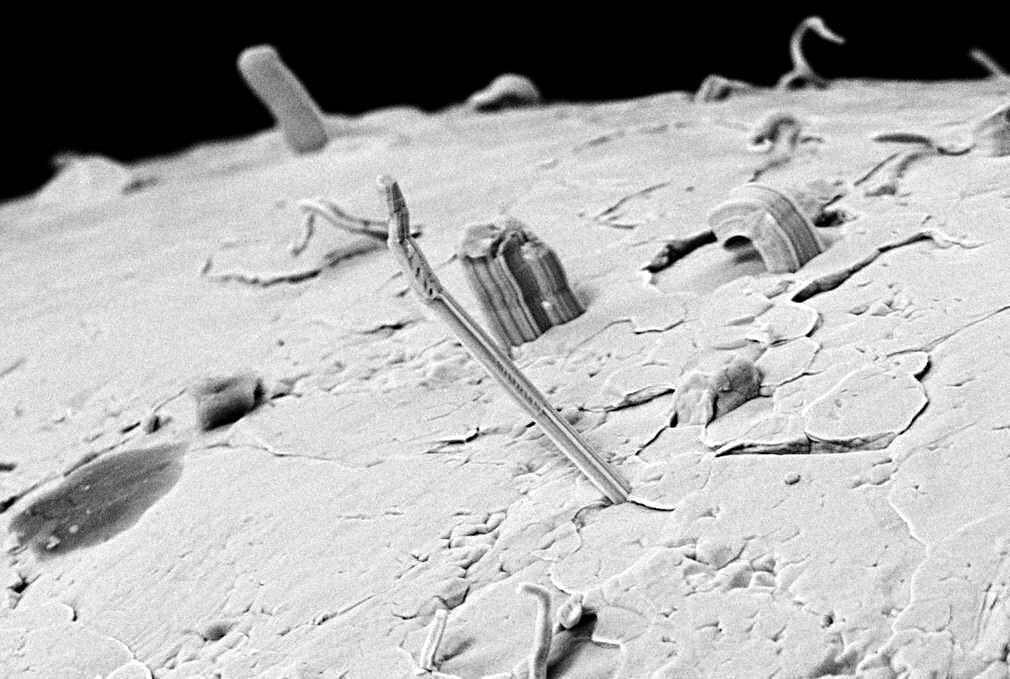

Intel's funding will primarily support four major fabrication facilities across Arizona, Ohio, New Mexico, and Oregon. The centerpiece is the $20 billion Arizona expansion, which aims to produce cutting-edge 3-nanometer and 2-nanometer chips by 2030.

The Ohio facility, dubbed "Silicon Heartland," represents a $20 billion investment that could eventually expand to eight fabs if market conditions support it. This facility is particularly strategic, as it's designed to serve both Intel's internal needs and external customers through its foundry services.

Technology and Workforce Development

Beyond manufacturing capacity, Intel is committing significant resources to workforce development. The company plans to train over 10,000 technicians and engineers, partnering with local universities and community colleges. This addresses one of the semiconductor industry's biggest challenges: the skilled worker shortage.

Intel is also investing in advanced packaging technologies and research and development capabilities, aiming to maintain competitiveness with Asian manufacturers who currently dominate global chip production.

The Broader Strategic Implications

National Security Considerations

The CHIPS Act funding isn't just about economic competitiveness—it's fundamentally about national security. Currently, the U.S. produces only about 12% of the world's semiconductors, despite consuming 25% of global production. This dependency creates vulnerabilities, as demonstrated during the COVID-19 pandemic when chip shortages disrupted everything from automotive to consumer electronics industries.

Intel's facilities will produce chips for both commercial and defense applications, including secure processors for military and government use. The $3 billion in additional defense contracts specifically target this capability.

Market Competition Dynamics

Intel faces intense competition from TSMC and Samsung, both of which have also received CHIPS Act funding for U.S. operations. TSMC's Arizona fabs are expected to begin production in 2028, while Samsung's Texas facility targets 2027. This creates a race to establish advanced manufacturing capabilities on American soil.

The funding also supports Intel's foundry ambitions—its effort to manufacture chips for other companies, competing directly with TSMC's business model. Success here could reshape the global semiconductor landscape.

What Happens Next

Immediate Milestones

Intel must meet specific construction and production milestones to receive funding disbursements. Key targets include beginning construction on new facilities by 2025 and achieving initial production by 2028-2030, depending on the location.

The company also faces requirements for domestic content, workforce development, and technology sharing that will influence how quickly and effectively it can deploy the funding.

Potential Challenges

Political risk remains significant. The incoming administration could modify CHIPS Act implementation, though the bipartisan nature of the original legislation suggests continuity is likely. Additionally, Intel must execute flawlessly on construction and technology development while managing its existing business challenges.

The Bottom Line

Intel's $7.86 billion award represents more than just government funding—it's a cornerstone of America's strategy to rebuild domestic semiconductor capabilities. While the money isn't "new," its finalization signals serious commitment from both Intel and the federal government to reshoring critical technology production.

Success will ultimately be measured not just in dollars invested, but in chips produced, jobs created, and national security enhanced. For Intel, the next decade will determine whether this massive bet pays off for shareholders, workers, and American technological independence.