Chinese Tech Giants Race to Stockpile Nvidia Chips as US Sanctions Thaw

Chinese technology companies are mounting an unprecedented purchasing blitz for Nvidia's advanced semiconductors, driven by anticipation that the Biden administration may soon ease restrictive export controls. This surge in demand highlights the critical importance of AI chips in the global technology race and the complex geopolitical dynamics reshaping international trade.

The Great Chip Rush

Industry sources report that major Chinese firms, including Alibaba, Tencent, and ByteDance, have significantly increased their orders for Nvidia's H100 and A100 graphics processing units (GPUs) – the gold standard for artificial intelligence training and inference. These companies are reportedly placing orders worth hundreds of millions of dollars, creating a supply shortage that has pushed delivery times from weeks to months.

The timing is strategic. With the Trump administration set to take office and potential policy shifts on the horizon, Chinese companies are moving aggressively to secure inventory before any potential reversal of current restrictions. This behavior mirrors the stockpiling patterns observed in other industries during periods of trade uncertainty.

Understanding the Current Landscape

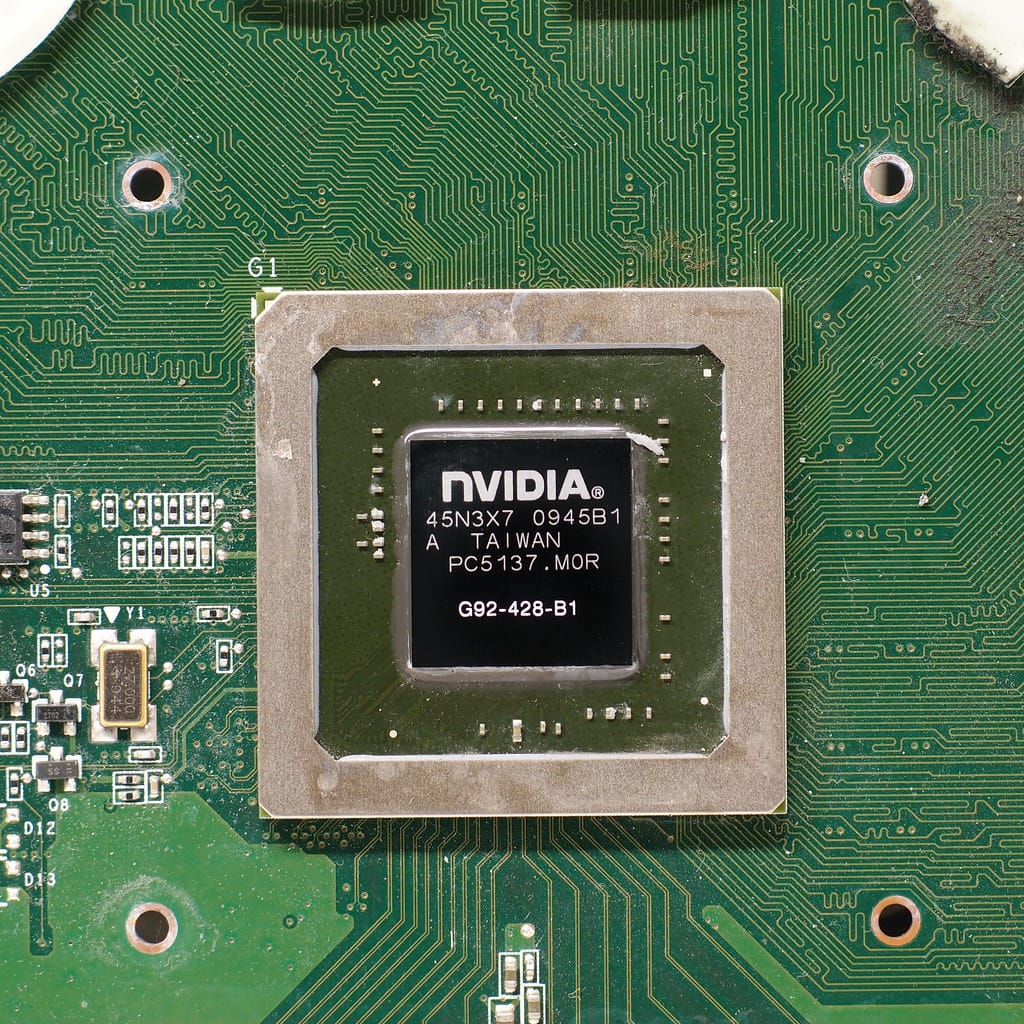

The current export restrictions, implemented in October 2022 and subsequently tightened, have severely limited Chinese companies' access to the most advanced AI chips. Nvidia, which controls roughly 80% of the global AI chip market, has been forced to develop specialized versions of its products for the Chinese market – chips that are powerful enough to comply with export rules but significantly less capable than their unrestricted counterparts.

The H20, Nvidia's China-specific chip, offers roughly 20% less performance than the H100, creating a substantial competitive disadvantage for Chinese AI companies. This performance gap has intensified demand for any available unrestricted chips, driving prices up by as much as 30% in some gray market channels.

Economic Implications

The semiconductor shortage has broader economic implications beyond individual companies. China's AI industry, valued at approximately $26 billion in 2023, relies heavily on these advanced chips for everything from autonomous vehicles to natural language processing. The restricted access has slowed development timelines and forced companies to explore alternative architectures and suppliers.

Domestic Chinese chipmakers like Huawei and Cambricon have attempted to fill the gap, but their products still lag behind Nvidia's offerings by several generations. This technological gap has made access to Nvidia chips a national priority, with some estimates suggesting that Chinese companies are willing to pay premium prices of 50-100% above market rates for guaranteed supply.

Geopolitical Chess Game

The semiconductor trade represents a crucial front in the broader US-China technological competition. The chips are essential for training large language models, developing autonomous systems, and advancing military applications. Control over this technology has become synonymous with national security and economic competitiveness.

Recent diplomatic discussions between Washington and Beijing have hinted at potential modifications to the current export control regime, particularly for civilian applications. However, any policy changes would likely maintain restrictions on military-related uses and the most advanced chip architectures.

Supply Chain Disruptions

The rush for Nvidia chips has created ripple effects throughout the global supply chain. Semiconductor distributors report unprecedented demand, with some clients offering to pay significantly above list prices for guaranteed allocation. This has led to the emergence of a secondary market where chips are traded like commodities.

Manufacturing partners in Taiwan and South Korea have been caught in the middle, balancing compliance with US export controls while meeting surging demand from Chinese customers. Some companies have established complex supply chain structures to navigate these regulatory requirements while maintaining business relationships.

Looking Ahead

The current situation highlights the fragility of global technology supply chains and the unintended consequences of export controls. While designed to limit China's access to advanced technology, these restrictions have also created market distortions and prompted accelerated development of alternative solutions.

Chinese companies' aggressive stockpiling strategy reflects both the immediate need for AI capabilities and long-term concerns about technology access. As the global AI race intensifies, control over semiconductor supply chains will remain a critical factor in determining competitive advantage.

The outcome of this chip rush will likely influence future trade policies and reshape the global technology landscape. For now, Nvidia finds itself at the center of a high-stakes game where technology, economics, and geopolitics converge, with Chinese companies betting heavily on securing their share of the world's most valuable semiconductors.