China's Solar Titans Cut 100,000 Jobs as Industry Boom Meets Reality Check

The world's solar manufacturing powerhouse is shedding workers at an unprecedented pace. Major Chinese solar companies eliminated roughly one-third of their combined workforce in 2023, cutting over 100,000 jobs as the industry grapples with oversupply, margin compression, and a brutal price war that's reshaping the global renewable energy landscape.

The Great Solar Workforce Reduction

The numbers paint a stark picture of an industry in transition. Leading manufacturers including LONGi Green Energy, JA Solar, and Trina Solar collectively reduced their headcount by approximately 35% throughout 2023, according to company filings and industry reports. LONGi, the world's largest solar panel manufacturer, alone cut nearly 20,000 positions—equivalent to eliminating the entire workforce of a mid-sized corporation.

This workforce reduction comes despite record-breaking solar installation figures globally. The International Energy Agency reported that solar capacity additions reached 346 GW in 2023, marking a 73% increase from the previous year. The paradox highlights a critical challenge: rapid capacity expansion has outpaced demand growth, creating a supply glut that's hammering profit margins.

Behind the Layoffs: Market Dynamics at Play

Oversupply Crisis

China's solar manufacturing capacity now exceeds global demand by an estimated 300%. The country's production capability reached approximately 500 GW annually by late 2023, while worldwide installations totaled just over 300 GW. This massive oversupply has triggered a devastating price war, with solar panel prices plummeting by more than 50% year-over-year.

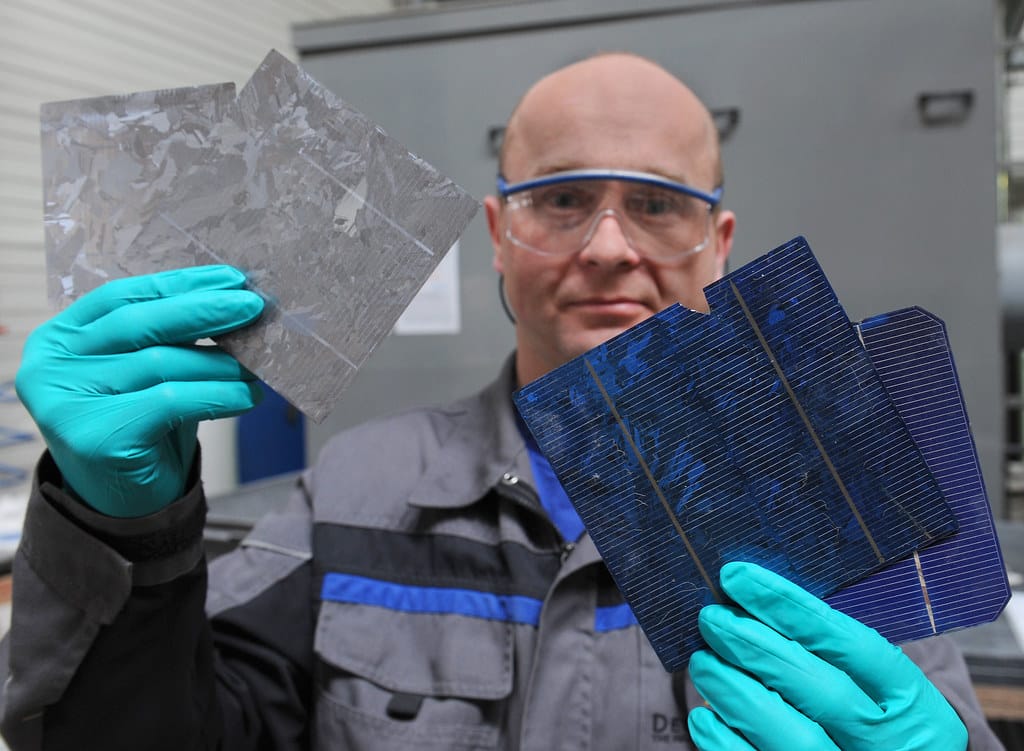

Automation and Efficiency Drive

The workforce reductions aren't solely about downsizing—they're also about technological advancement. Chinese manufacturers have invested heavily in automated production lines, reducing their reliance on manual labor while increasing output efficiency. Advanced robotic systems now handle tasks previously requiring dozens of workers, from silicon wafer cutting to final panel assembly.

Government Policy Shifts

Beijing's evolving industrial policy has also influenced workforce decisions. The government's push for "high-quality development" emphasizes technological innovation over pure scale expansion, encouraging companies to focus on premium products rather than volume-driven strategies that require massive workforces.

Global Ripple Effects

The Chinese solar industry's workforce adjustments are reverberating worldwide. European and American solar manufacturers, already struggling to compete with Chinese pricing, face even greater pressure as their rivals become leaner and more cost-efficient. This dynamic is intensifying calls for trade protections in Western markets, with the U.S. recently extending anti-dumping duties on Chinese solar imports.

Meanwhile, downstream solar installers and project developers globally are benefiting from dramatically lower equipment costs, accelerating the deployment of renewable energy projects and bringing solar power closer to grid parity in more markets.

Innovation Through Adversity

Despite the workforce reductions, Chinese solar companies are doubling down on research and development. LONGi increased its R&D spending by 15% in 2023, while simultaneously cutting operational staff. The company achieved multiple world records for solar cell efficiency, demonstrating how the industry is channeling resources toward technological breakthroughs rather than capacity expansion.

Advanced technologies like perovskite tandem cells, bifacial panels, and next-generation silicon processing are emerging from these leaner, more focused organizations. This innovation push suggests that the current workforce reduction may be laying the groundwork for the next phase of solar technology evolution.

Looking Ahead: Industry Transformation

The solar industry's workforce contraction represents a maturation process rather than decline. As manufacturing becomes increasingly automated and companies focus on higher-value products, the sector is evolving from a labor-intensive industry to a technology-driven powerhouse.

Industry analysts predict that while total employment may continue declining in the near term, the quality of remaining jobs will improve significantly. Engineers, researchers, and automation specialists are becoming the core workforce, replacing assembly line workers in the new solar economy.

Key Takeaways: China's solar giants are restructuring for long-term competitiveness, trading workforce size for technological advancement. While job cuts create short-term challenges, they're accelerating automation and innovation that could ultimately make solar energy even more affordable globally. This transformation signals the solar industry's evolution from rapid expansion to sustainable, technology-driven growth—a shift that will define renewable energy manufacturing for years to come.