Broadcom's Audacious Response to VMware Pricing Fury: "You're Just Using It Wrong"

Broadcom has delivered a brazen response to the widespread outcry over its VMware pricing strategy since acquiring the virtualization giant for $69 billion in 2022: customers complaining about cost increases simply don't understand how to use the software properly. This bold stance has sent shockwaves through the enterprise IT community, where many organizations report seeing their VMware bills increase by 300-500% or more.

The Great VMware Pricing Revolt

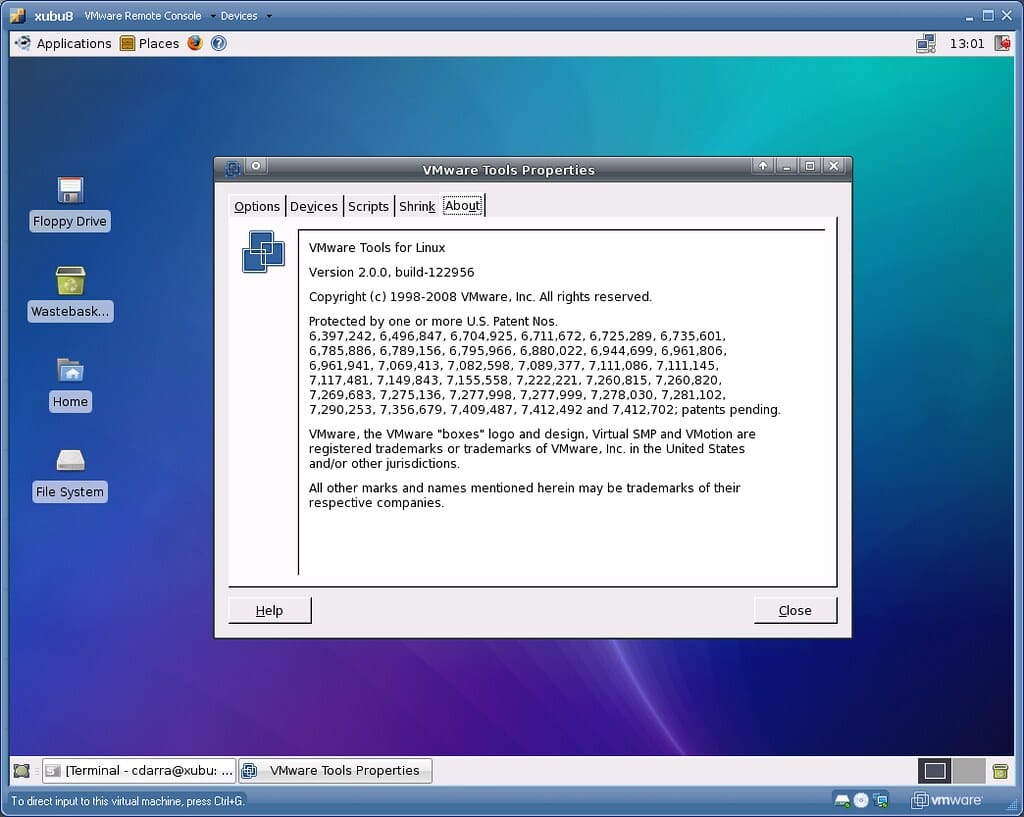

Since Broadcom completed its acquisition of VMware, the enterprise software landscape has been in upheaval. The company immediately began restructuring VMware's licensing model, eliminating perpetual licenses in favor of subscription-only offerings and bundling previously separate products into comprehensive suites.

The fallout has been swift and severe. According to recent surveys by IT research firms, over 70% of VMware customers are actively exploring alternatives, with many already beginning migrations to competitors like Microsoft Hyper-V, Nutanix, or open-source solutions like Proxmox.

"We went from paying $150,000 annually for our VMware environment to being quoted $800,000 under the new pricing structure," said a senior IT director at a Fortune 500 manufacturing company who requested anonymity. "That's not a price increase—that's extortion."

Broadcom's Counteroffensive

Rather than backing down, Broadcom executives have doubled down on their strategy. In recent customer briefings and industry events, company representatives have argued that organizations experiencing dramatic price increases are fundamentally misunderstanding how to optimize their VMware deployments.

The "Efficiency Argument"

Broadcom's core argument centers on what they call "hypervisor sprawl"—the tendency for organizations to deploy more virtual machines and use more licensing than necessary. Company executives claim that their new bundled approach, while appearing more expensive upfront, actually delivers better value by forcing customers to consolidate and optimize their infrastructure.

"Many customers have been running inefficient, over-provisioned environments for years," explained a Broadcom spokesperson during a recent webinar. "Our new licensing model encourages best practices that ultimately reduce total cost of ownership."

The Portfolio Integration Play

Broadcom also emphasizes that their pricing reflects the integration of VMware's entire portfolio, including previously separate products like vSAN storage, NSX networking, and Tanzu Kubernetes platform. They argue that customers who previously purchased these components separately are now getting a comprehensive solution at a comparative discount.

Industry Pushback Intensifies

The enterprise IT community remains largely unconvinced by Broadcom's explanations. Industry analysts note that while some organizations may indeed benefit from forced optimization, the majority of VMware customers had already invested heavily in right-sizing their environments before the acquisition.

Migration Momentum Builds

Several high-profile organizations have publicly announced their departure from VMware. The German software company SAP recently revealed plans to migrate away from VMware for its internal infrastructure, citing unsustainable cost increases. Similarly, numerous government agencies and educational institutions have begun procurement processes for VMware alternatives.

Cloud providers have seized the opportunity, with Amazon Web Services, Microsoft Azure, and Google Cloud all launching enhanced VMware migration services and offering significant incentives for organizations looking to abandon on-premises virtualization entirely.

The Competitive Landscape Shifts

Traditional VMware competitors are experiencing unprecedented growth. Nutanix reported a 40% increase in competitive displacement deals in their most recent quarterly earnings, while Microsoft has seen significant uptake in its Hyper-V migration programs.

The Broader Implications

Broadcom's aggressive approach represents a high-stakes bet on customer lock-in versus competitive pressure. While some large enterprises may indeed find value in the forced consolidation and optimization, the company risks alienating a significant portion of VMware's installed base.

What This Means for IT Leaders

For IT decision-makers, Broadcom's stance clarifies that significant price relief is unlikely. Organizations should prepare for the new reality by:

- Conducting thorough cost-benefit analyses of their current VMware deployments

- Evaluating alternative virtualization platforms before contracts expire

- Engaging with multiple vendors to understand migration costs and timelines

- Considering hybrid approaches that gradually reduce VMware dependency

The ultimate test of Broadcom's strategy will be whether their efficiency arguments prove compelling enough to retain customers willing to pay dramatically higher prices, or whether the exodus continues as organizations find viable alternatives in an increasingly competitive virtualization market.